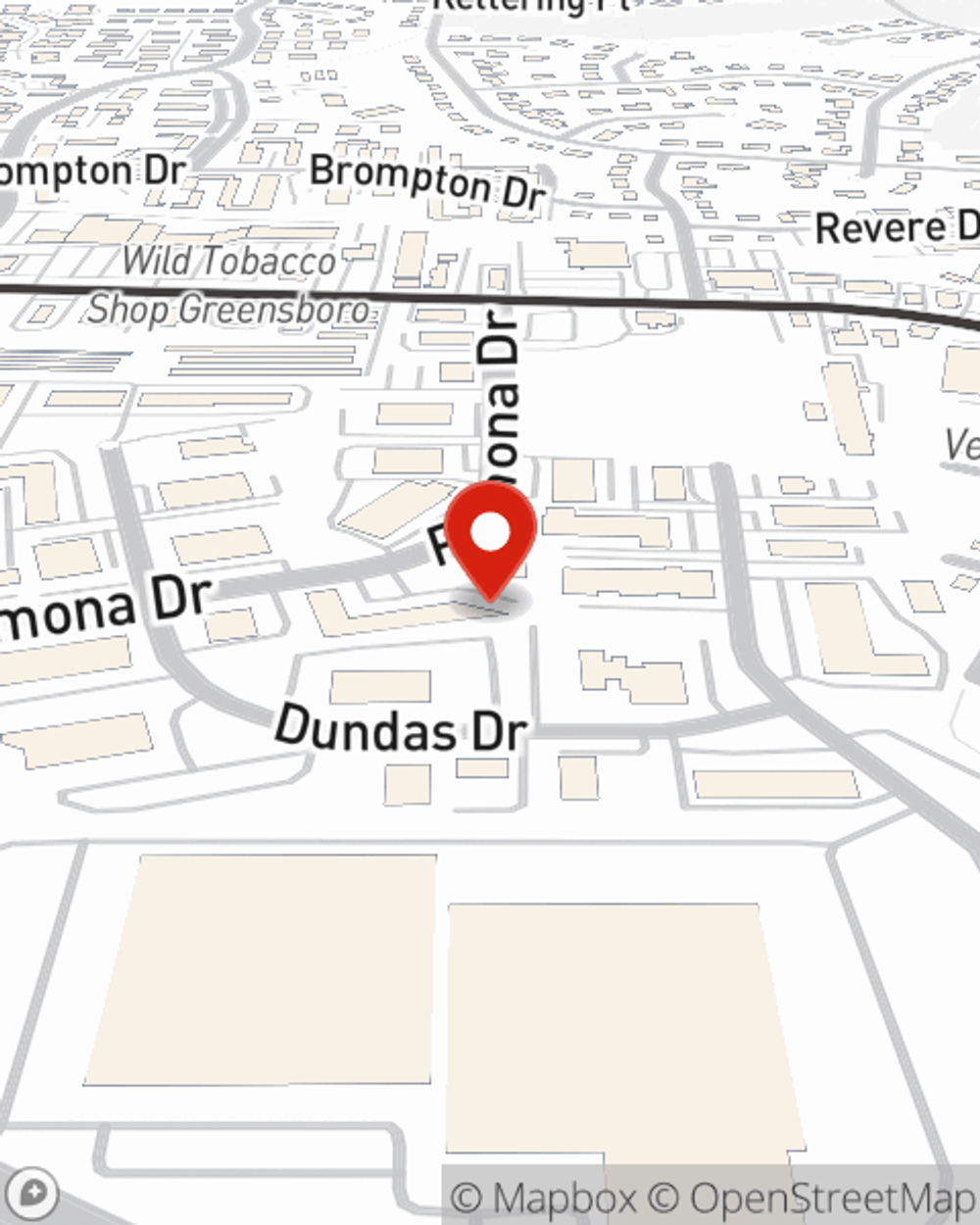

Business Insurance in and around Greensboro

Get your Greensboro business covered, right here!

This small business insurance is not risky

Coverage With State Farm Can Help Your Small Business.

You may be feeling like there is so much to do with running your small business and that you have to handle it all by yourself. State Farm agent Amber Smith, a fellow business owner, recognizes the responsibility on your shoulders and is here to help you put together a policy that's right for your needs.

Get your Greensboro business covered, right here!

This small business insurance is not risky

Keep Your Business Secure

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your compensation, but also helps with regular payroll costs. You can also include liability, which is crucial coverage protecting your business in the event of a claim or judgment against you by a consumer.

Visit the wonderful team at agent Amber Smith's office to explore the options that may be right for you and your small business.

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Amber Smith

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.